[How to] Overcome the Impact of Covid-19 and Scale Your Retail Business

It has been more than a quarter now since Covid-19 came into our lives. From living without going outdoors to practicing social distancing to wearing a mask to washing/cleaning hands frequently, we live in fear of Covid-19 every day.

Not only has it impacted our lives, Coronavirus Pandemic has forced businesses across the world to suspend operations.

Because of lockdown during Covid-19, physical stores are not operational. This has increased the number of online users exponentially. Contactless deliveries are trending nowadays where customers must do online payments only while doing online shopping.

For the rest of this year and into 2021, consumers are going to have different expectations for their shopping experience, particularly when it comes to health and safety precautions.

Now it is very important for brands and retailers to move their business from offline to online because it is the need of the hour.

Covid-19 Impact in Ecommerce Revenue

Ecommerce sales are not high across the board, although some industries are seeing significant upticks. This is especially true for online sellers of household goods and groceries.

JD.com, China’s largest online retailer, has seen sales of common household staples quadruple over the same period last year. A survey by Engine found that people are spending on an average 10-30% more online.

Grocery ecommerce

Grocery ecommerce soared in the second week of March, after shoppers turned online to find the goods that were not available at their local grocery stores.

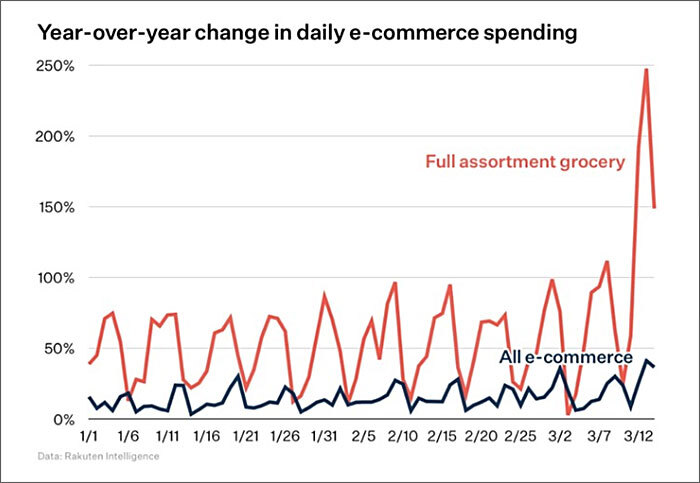

The following graph, with data from Rakuten Intelligence, shows a huge spike in grocery-related ecommerce. The rest of ecommerce seems like it might be up a little bit, but no drastic peaks or valleys.

Other ecommerce categories

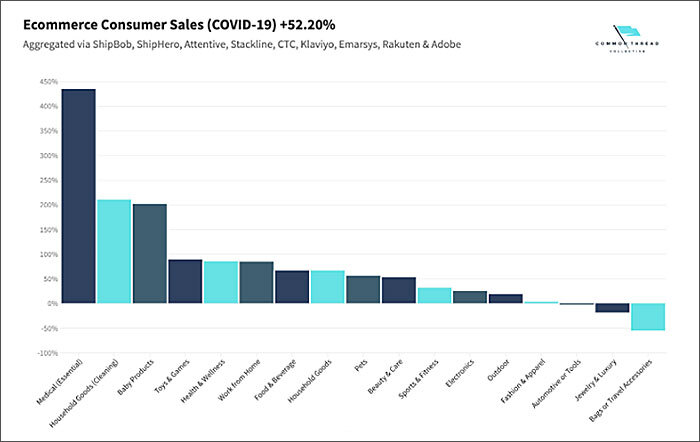

In addition to grocery, ecommerce covers a wide number of products, across categories. Common Thread Collective has been providing valuable updates with COVID data on ecommerce shopping behaviour, including the chart below.

While ecommerce performance is not generally up or down, breaking down the data by vertical tells a bit more of the story.

Subscription services

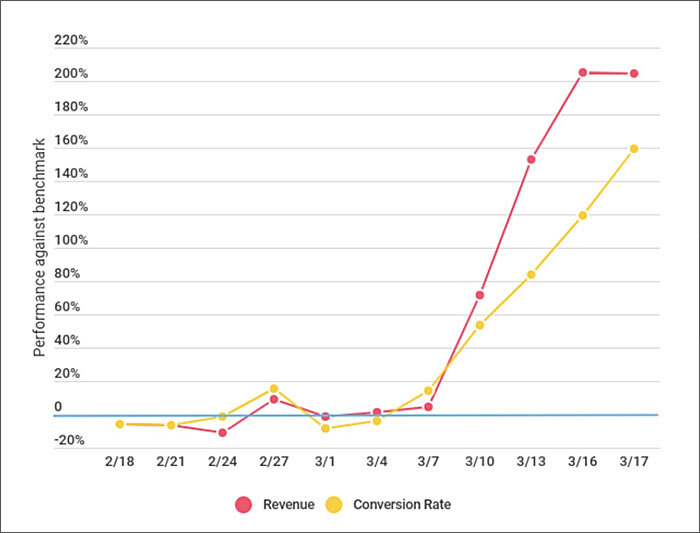

While ecommerce sales do not generally appear to be skyrocketing as one might expect, there are some exceptions. One of these is in subscription and convenience services, which have seen significant upward trends in both revenue and conversion.

Performance branding company WITHIN has been tracking the effects of COVID-19 on ecommerce across a number of specific sectors by monitoring and comparing data from select businesses year-over-year. This graph comes from their observations.

Product Categories Shifting During COVID-19

As people are making buying choices based on new and ever-changing global and local circumstances, the product categories that are being purchased are also changing.

Market research company Nielsen has identified six key consumer behaviour thresholds tied to the COVID-19 pandemic and their results on markets.

These are:

- Proactive health-minded buying (purchasing preventative health and wellness products)

- Reactive health management (purchasing protective gear like masks and hand sanitizers)

- Pantry preparation (stockpiling groceries and household essentials)

- Quarantine prep (experiencing shortages in stores, making fewer store visits)

- Restricted living (making much fewer shopping trips, limited online fulfilment)

- A new normal (return to daily routines, permanently altered supply chain)

China’s Recovery from Covid-19

Talking about a country like China which has recovered from Covid-19 with the new normal –

- China’s reopening: 50% consumers are optimistic that their economy may recover soon after the end of this pandemic.

- Stickiness to digitalization: >55% consumers are more likely to buy groceries online, leading RE firms to use “virtual showrooms” with in-house salesforce.

- Even traditionally physical-dominant sectors were forced to go digital: e.g. direct-to-streaming film distribution bypassing cinemas.

- Decoupling of the connected world/localization: Japan has earmarked US$2.2B to help manufacturers shift production out of China; similar calls in US and Australia.

- Accelerated retreats: Samsung has announced moving manufacturing out of China. Widening performance gaps: Resourceful players who use digital are growing. ByteDance (TikTok) is hiring 10K new employees in analytical fashion.

- People unable to embrace remote working trends face a downturn: ~2.3mn people claimed unemployment insurance in Jan and Feb.

- Selectiveness in spending: Overall spending lowered (consumer confidence index decreased ~7% in March YoY), but consumers over-index on healthy products (e.g. ~75% consumers with strong preference to exercise and healthy eating post crisis; e.g. ZhongAn PHI premium grew 60%+).

- Stakeholder capitalism: Private sector becoming a significant force to accelerate country agenda: e.g., “Health Code” by Alibaba; Taikang owned hospital leading virus fight.

Metamorphosis of Demand

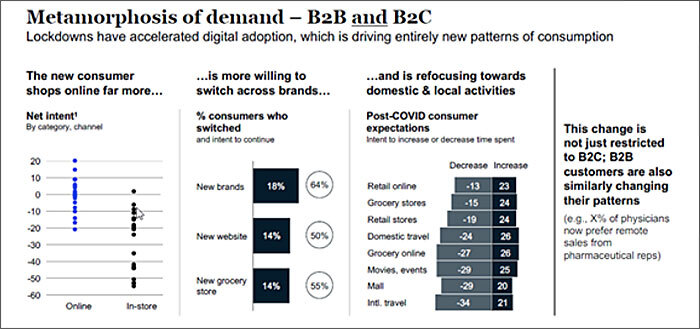

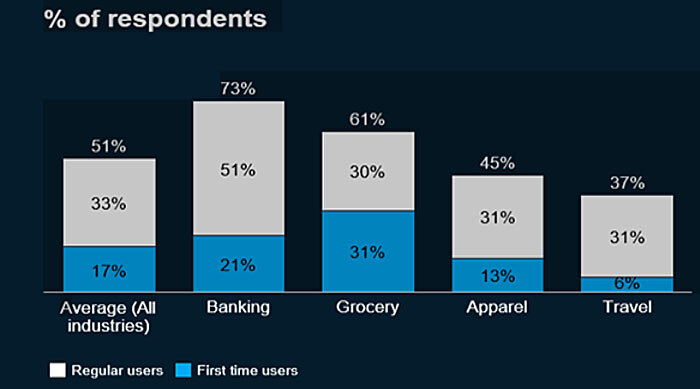

Increased online sales is not a new phenomenon, but the speed with which new generations of consumers have gone online (20- 60% more consumers are now digital) has led to a metamorphosis of demand that is unlikely to reverse quickly.

It is also generating entirely new patterns of behavior. Switching for instance has accelerated. In a world of lower overall consumption, access to the digital consumer dollar is shaping the new resilient.

Most first-time customers (~86%) are satisfied/ very satisfied with digital adoption and majority (~75%) plan to continue using digital post-COVID.

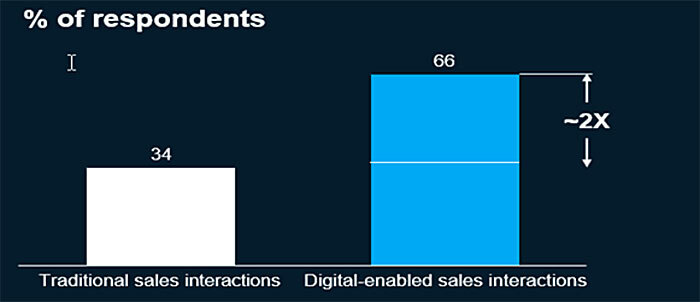

B2B decision makers believe digital sales interactions will be ~2X more important than traditional interactions in the next few weeks (vs equally important pre-COVID).

How You can Scale Your Retail Business

- For a brand having its own website, it can use SaaS based omni channel retailing platforms, showcase its store inventory online, use the OMS engine and opt the ship-from-store option to convert the store as a fulfilment centre for online order delivery. There are many options available to ship-from-store. One of the leading brands has shipped 10 lakh orders in a single day on converting its stores into Fulfilment centres.

- Can be using 3PL integration for last mile deliveries

- Can be done using the hyper local delivery partners like Dunzo, Scootsy which provides instant delivery services to the customers. This provides an excellent shopping experience to the customer

- Brands and retailers can start selling on online marketplaces. There is a need to increase the number of sales channels using SaaS based multi-channel retailing solutions. With the cloud-based system, there would be no risk of server management and access location issues. It would lead to a reduced infrastructure, hardware, software, and licensing cost.

- Many marketplaces support self-ship/ship-by-seller options where the seller must use its own 3PL partner to do the last mile deliveries. Using self-ship options, brands and retailers can even do ship-from-store for marketplace orders.

- For brands having multiple distributors and warehouses, by using omni channel retailing platforms they can showcase the distributor inventory online, which results in an increase in the number of orders and can do the fulfilment using last mile delivery partners or hyper local delivery partners.

- Retailers who are dealing with FMCG products can use hyper local delivery apps as sales channels/marketplaces. Example: Zomato, Swiggy, Uber Eats, Dunzo, Scootsy.

Covid-19 Global Marketing Trends

Slash advertising spends

Brands are slashing advertising spend for 2020 to the tune of a huge $50 billion globally in 2020., an 8.1% plunge from 2019.

The most severe falls will be recorded in travel & tourism (-31.2%), leisure & entertainment (-28.7%), financial services (-18.2%), retail (-15.2%) and automotive (-11.4%).

Move back to basics

Brands are moving back to basics: service and trust. Trust is crucial during this time. Most importantly, any ‘sell sell sell’ agenda has been largely parked.

Consumers are, for the most part, simply not interested in pushiness at the moment. They want security and positivity from advertising during COVID-19.

Reach where your customers shop

During COVID-19, retailers big and small have been scrambling to set up an online presence, with mixed results.

Those brands which have spent the last couple of years investing in their online customer journeys – be it via their website, app, or in new technologies such as livestreaming – are now seeing the payoff.

Bring Innovation in Marketing

Marketing teams need to embrace an agile culture of innovation and creativity when every day brings a new challenge.

Brands are finding new ways to work, crunching numbers quickly and making fast decisions in large, previously bureaucratic organisations.

Want to know how Vinculum can help you scale your business. Leave a comment below and we will get back to you!

Author Bio:

Md. Farhan Khan works at Vinculum Group as a Product Manager. Having 5+ years of experience in Ecommerce and Retail Industry, Farhan is a dynamic, competent, result oriented professional and an expert in product integrations.

Subscribe to our blog and stay updated!

By completing this form, I agree to Vinculum’s privacy policy